Montserrat Real Estate Market: Comprehensive Investment Guide

Looking for a hidden gem in Caribbean real estate? Montserrat may be one of the region’s best-kept secrets. With dramatic volcanic landscapes, a secure British legal structure, and some of the most affordable luxury homes in the Eastern Caribbean, this quiet island is gaining attention from global investors, second-home buyers, and high-net-worth families seeking long-term value and lifestyle freedom.

Whether you're searching for a beachfront villa, planning to build a private estate, or diversifying into offshore real estate, the Montserrat property market offers a compelling mix of stability, upside, and natural beauty.

Since the Soufrière Hills eruption in the 1990s, and several others recently, Montserrat has undergone a quiet transformation. The southern half of the island was designated an exclusion zone, but its safe and thriving northern region has developed steadily—now offering excellent infrastructure, peaceful communities, and untapped investment opportunities. Real estate values remain significantly below regional averages, positioning Montserrat as a smart long-term play for savvy investors.

Why Invest in Montserrat Real Estate?

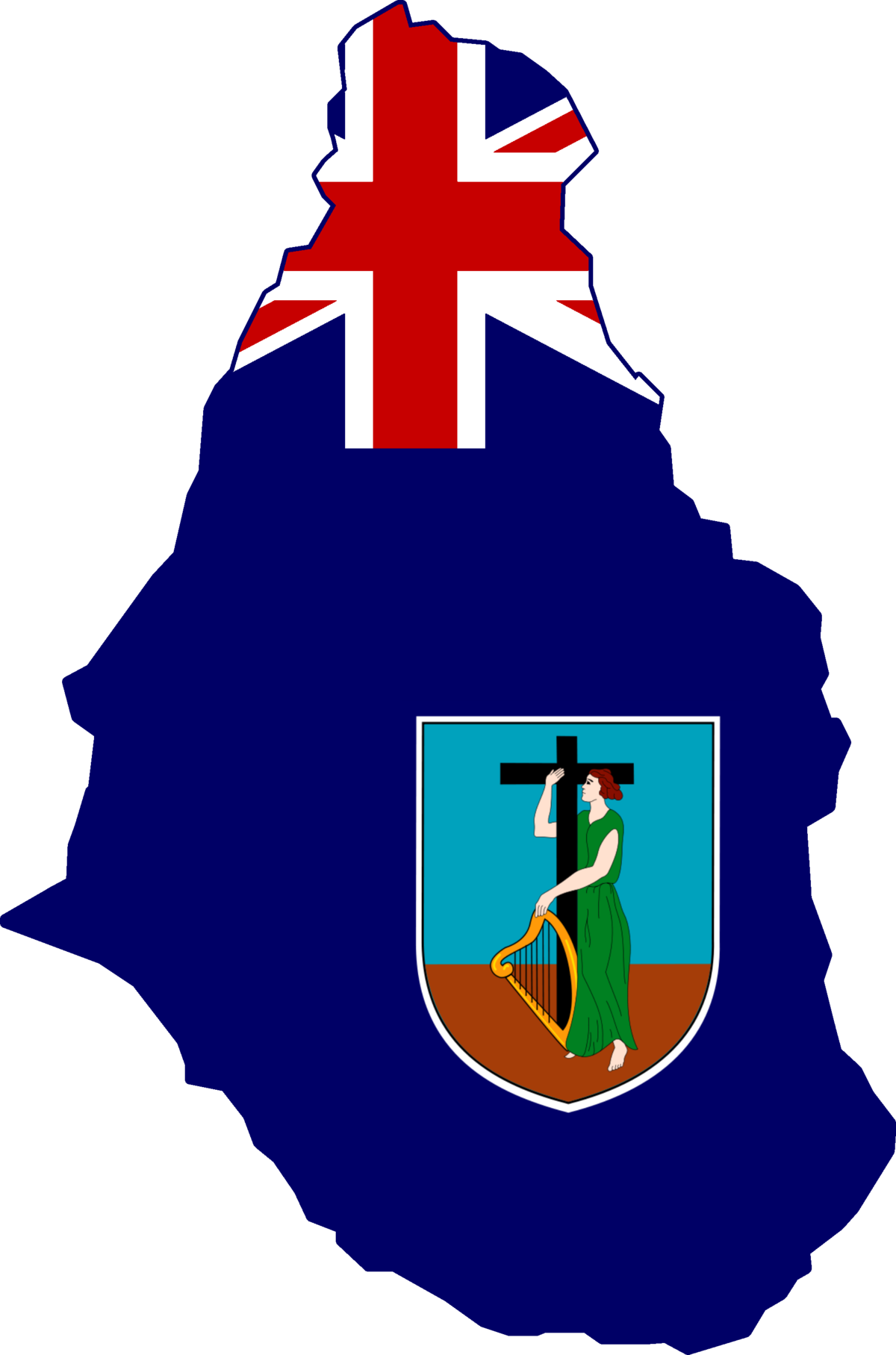

Montserrat is a British Overseas Territory

Montserrat is one of the last truly accessible Caribbean real estate markets that still offers genuine value without compromise. At a time when prices on neighboring islands have surged and speculative development has outpaced infrastructure, Montserrat remains grounded—offering ocean-view homes, freehold land, and long-term investment potential in a stable, low-risk environment. It’s a place where you can still find peace, privacy, and panoramic views at a fraction of the cost seen in markets like the Cayman Islands or Anguilla.

What sets Montserrat apart isn’t just price—it’s the combination of British legal protections, a welcoming stance toward foreign ownership, a U.S. dollar-based economy, and an unspoiled natural setting that feels more like the Caribbean of 30 years ago. Investors and second-home buyers aren’t just acquiring property here—they’re buying into a jurisdiction that values transparency, low density, and sustainable growth.

Whether you're drawn by the low cost of entry, the clarity of title ownership, or the appeal of investing in an authentic, under-the-radar destination, Montserrat offers a unique opportunity to secure a foothold in the Caribbean without the noise and volatility of more commercialized markets.

1. British Legal Framework and Clear Title Ownership

As a British Overseas Territory, Montserrat operates under a legal system modeled after UK common law. Foreign buyers enjoy full land ownership through Freehold Land Certificates, and the legal process is conducted entirely in English. This structure offers predictability and confidence to international investors, particularly those from common-law countries.

2. Streamlined Process for Foreign Buyers

Unlike other Caribbean jurisdictions, Montserrat welcomes foreign buyers with minimal restrictions. There is no citizenship or residency requirement to own property. Local solicitors handle due diligence, contracts, and closings efficiently—making the buying experience straightforward and transparent.

3. U.S. Dollar-Based Transactions and Strong Fundamentals

All property transactions in Montserrat are completed in U.S. dollars, providing currency stability and eliminating conversion risk. With relatively low real estate prices and steady long-term demand, Montserrat offers strong fundamentals for both lifestyle and investment-driven buyers.

4. Pristine Natural Environment and Lifestyle Appeal

Montserrat remains one of the Caribbean’s most unspoiled destinations. With black sand beaches, rainforests, hiking trails, and panoramic sea views, it’s ideal for those seeking privacy and connection to nature. Its low crime rate, small population, and absence of mass tourism make it particularly attractive to retirees and families looking for a secure second home.

Tips for Buying Property in Montserrat

Work with a Knowledgeable Agent

Given Montserrat’s small population, the local real estate market is limited in both inventory and agents. Collaborating with a trusted advisor—ideally someone who understands the regional dynamics, including nearby Antigua and Nevis—can help you identify opportunities, structure offers, and avoid common pitfalls.

Understand the Buying Process

Foreigners can own freehold property with few restrictions. The process includes an offer and acceptance, a deposit (usually 10%), due diligence (title search, survey), and a final closing. All transactions are conducted in English, and legal support is widely available. Solicitors guide buyers through the issuance of a Freehold Land Certificate, which confirms legal ownership.

Take a Long-Term View

Montserrat is a low-turnover market with limited speculative activity. Investors should adopt a long-term horizon, with potential for cash flow through rentals and capital appreciation as infrastructure improves and tourism increases. For families, retirees, or remote professionals, the lifestyle return is immediate—while the financial return is built over time.

Factors to Consider When Investing in Montserrat Real Estate

Location Matters

Northern Montserrat is where nearly all real estate activity occurs today. The west coast—especially areas like Olveston, Woodlands, Salem, and Little Bay—offers proximity to beaches, restaurants, and the island’s core infrastructure. Elevated communities like Lookout and Blakes provide panoramic Atlantic views and greater privacy. Avoid the exclusion zone in the south.

Budget Planning

Entry-level homes with ocean views start at approximately $365,000 USD, while larger, high-spec villas can range from $500,000–$800,000+. Land parcels begin as low as $50,000 depending on location and elevation. Additional costs include legal fees, stamp duty (~4-6%), and potential furnishings or renovations.

Market Conditions

Post-volcano, the market has grown slowly but steadily. Demand remains consistent from expats, retirees, and long-term investors. With tourism projected to rise and development expanding in Little Bay, there is clear long-term potential. That said, liquidity is limited, so buyers should expect to hold for 5+ years.

Legal & Tax Considerations

Montserrat does not impose capital gains, inheritance, or wealth taxes, which is especially attractive to international buyers and HNW individuals seeking to optimize their offshore structures. All real estate is titled and registered, and full ownership is available to foreigners. Transactions are clean, simple, and legally enforceable.

Availability of Properties in Montserrat

Residential Real Estate

Montserrat’s residential real estate market offers a surprisingly diverse range of homes given the island’s small size and low density. Properties include traditional Caribbean bungalows, hillside cottages, colonial-inspired villas, and modern homes designed to capture panoramic sea or mountain views. Most homes sit on generous freehold lots, often half an acre or more, offering privacy and space that’s increasingly rare in the region.

Many properties are sold fully furnished, making them ideal for turnkey use as either private residences or short-term rentals. While finishes can vary, there are opportunities to renovate or modernize existing homes to meet higher design standards. Importantly, new construction is beginning to gain traction, with a slow but growing wave of design-forward, architect-led homes targeting international buyers seeking bespoke retreats. However, due to limited local materials and contractors, build timelines are longer than on more developed islands—making resale homes a practical choice for immediate occupancy.

The residential market remains thin but resilient. Most owners are long-term residents or expats, which keeps inventory relatively low and turnover slow. For investors and second-home seekers, this also means less speculative volatility and a more stable environment to own.

Land and Development Sites

For buyers with a long-term vision, land in Montserrat represents one of the most accessible and strategic property types available. Parcels range from flat, build-ready lots in established areas like Olveston and Lookout, to rugged, forested acreage suitable for eco-retreats or future villa compounds. Cliffside plots with west-facing views of the Caribbean Sea are particularly sought after, offering spectacular sunsets and natural privacy.

Land prices begin around $50,000 USD for smaller inland plots and increase with elevation, view, and proximity to key infrastructure. The lack of speculative building means much of Montserrat’s land remains undeveloped, allowing investors to secure high-quality sites before future demand increases.

Buyers should be aware that construction logistics on the island are not turnkey. Building materials and architectural services are often sourced from Antigua, and while local tradespeople are available, larger builds typically involve coordination with off-island contractors. This adds complexity but also ensures a higher standard of finish for those seeking modern construction. Government support for sustainable design and low-impact building practices may further enhance the long-term value of environmentally sensitive projects.

Commercial Properties

Montserrat’s commercial real estate sector is still in its early stages, but that presents an opportunity for forward-looking investors. The island’s tourism and hospitality infrastructure remains modest, but government plans to revitalize areas like Little Bay and Carr’s Bay are driving renewed interest in guesthouses, boutique hotels, and mixed-use properties that combine retail, hospitality, and residential components.

Commercial inventory is limited—often comprising older buildings in need of repositioning—but the long-term potential lies in first-mover advantage. Strategic sites near the ferry terminal, cultural centers, or future marina projects offer interesting upside, particularly for investors with a hospitality or wellness background. Demand for coworking spaces, wellness resorts, and lifestyle-focused accommodations is expected to rise as Montserrat continues to attract digital nomads, retirees, and nature-oriented travelers.

Investors should be prepared for longer permitting timelines and a heavier reliance on private financing, but the regulatory environment is stable, and foreign ownership of commercial property is fully permitted.

Vacation Rentals

Short-term rentals represent one of the most immediate and proven pathways to ROI in the Montserrat real estate market. With a growing number of eco-tourists, returning expats, and digital professionals seeking peaceful stays in authentic Caribbean settings, high-quality rental homes are in increasing demand.

Properties like the Miles Away Resort in Olveston—a seven-bedroom estate with lush gardens, expansive decks, and panoramic sea views—illustrate what’s possible at the top end of the rental market. The appeal lies in Montserrat’s privacy, safety, and natural setting, which creates a premium experience without the need for flashy amenities or overbuilt resort zones.

Most vacation rentals on the island are owner-managed or handled through local concierge services. There’s room for more sophisticated rental operations, particularly those that focus on medium- to long-term stays, wellness tourism, or artist retreats. Because of the island’s limited hotel stock, well-managed homes often enjoy strong seasonal demand and excellent guest satisfaction.

For buyers not yet ready to relocate full time, vacation rentals offer a chance to offset holding costs, build a guest base, and test the market before committing to longer-term expansion or development.

Pros and Cons of Investing in Montserrat Real Estate

Pros

Investing in the property market of Montserrat presents some noteworthy advantages. Notably, since the Soufriere Hills eruption, real estate prices have become increasingly attractive, with a variety of properties available at competitive rates. Here's why one might consider investing on this beautiful Caribbean island:

Post-Volcanic Price Advantage: The market offers desirable properties at enticing prices. An array of residential options ranging from luxurious Caribbean homes with pools and exquisite views to well-maintained apartments can be procured, often fully furnished, meaning I can move in right away.

Hassle-Free Process for Non-Citizens: The Montserrat government is very welcoming of expat investments, smoothing the process for non-citizens to purchase property.

USD Currency: All transactions are conducted in US dollars, providing a stable currency base for international investors.

Immediate Title Transfer: Upon purchase, the immediate issuance of a Freehold Land Certificate or property title is guaranteed, giving me instant ownership without any delays.

Tourist and Expatriate Appeal: Montserrat's tranquil beauty attracts tourists and expatriates alike. Many visitors become property owners, drawn by the island’s charm and the potential for making lasting memories.

Cons

However, as with any investment decision, it's vital to be mindful of potential downsides:

Isolated Economy: Montserrat's economy relies heavily on a few sectors such as tourism and construction. This lack of diversification might lead to potential risks if these sectors were to face challenges.

Limited Job Market: The island has very little manufacturing or service based jobs, which could limit economic growth prospects and reduce the potential for job creation, which in turn could have an impact on rental markets.

Natural Disaster Risk: The historical volcanic activity has had a significant impact on the island, and it's a factor that I must consider, both in terms of personal safety and investment stability. Montserrat is also in the medium-risk hurricane zone.

Considering these pros and cons, real estate investment in Montserrat, a quaint British Overseas Territory, certainly appears to hold potential, especially for those seeking a serene Caribbean lifestyle and a market with promising entry prices. However, I must weigh these against the economic risks of a small, recovering economy and the potential for natural events that could affect the real estate market's growth.

The Future of the Montserrat Real Estate Market

Montserrat’s real estate market is more than just an undiscovered opportunity—it’s one of the last places in the Caribbean where value, lifestyle, and long-term stability still align. Like the Cayman Islands two decades ago or Turks and Caicos before the boom, Montserrat today offers investors a rare chance to secure a foothold in a British Overseas Territory before the rest of the world catches on.

Backed by strong legal protections, full freehold ownership for foreigners, and a U.S. dollar-based economy, Montserrat delivers the transparency and security global investors demand—without the congestion, speculation, or overdevelopment seen on other islands. Its breathtaking natural beauty, affordable pricing, and favourable tax environment make it especially attractive for high-net-worth individuals, families, and second-home buyers looking to blend lifestyle with long-term upside.

Whether your goal is to build a legacy beachfront villa, establish a Caribbean base for global mobility, or generate income through short-term rentals in a low-density market, Montserrat presents a unique, high-conviction opportunity.

This isn’t just a place to park capital—it’s a place to build something lasting. A place to live well, invest wisely, and become part of an emerging story. If you're ready to explore what’s next, let’s unlock the full potential of Montserrat together—and turn your vision of island ownership into reality.

Bio

Dan Merriam

Caribbean Real Estate Investor

Advisor @ Sotheby’s International Realty

Partner @ InvestCARICOM

Helping high-net-worth investors and global families buy and sell Caribbean real estate, navigate citizenship by investment, and implement cross-border strategies for residency, tax optimization, and long-term wealth protection. Dan specializes in luxury development, CBI-approved property, and strategic relocation throughout under-the-radar jurisdictions like Montserrat, Nevis, Dominica, and Antigua.

Schedule a personalized 1-on-1 consultation with Dan Merriam to explore second citizenship, international real estate, or offshore residency strategies tailored to your lifestyle and long-term goals. Whether you're seeking visa-free mobility, investment diversification, or a private island retreat, Dan provides trusted access, on-the-ground insight, and strategic execution. As a representative of Sotheby’s International Realty and partner at InvestCARICOM, he helps clients confidently navigate high-value decisions and build generational freedom through global real estate.

Writer in Tax Reduction, International Tax Planning, Travel Hacking, Citizenship by Investment, Caribbean, Second Residence, Real Estate Investing, Asset Management, Lifestyle Planning, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship

This article is for informational purposes only; it should not be considered financial, tax planning or legal advice. Consult a financial or investment professional before making any major financial decisions.